If i pay 200 extra on my mortgage

Answer 1 of 4. If youre able to make 200 in extra.

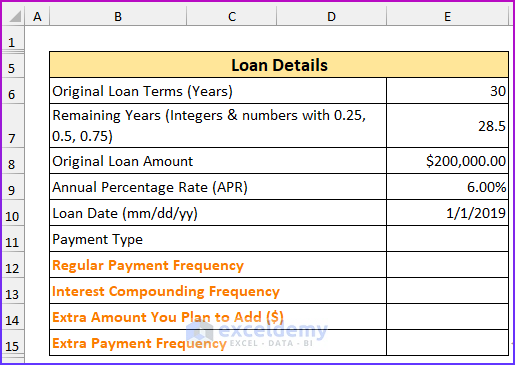

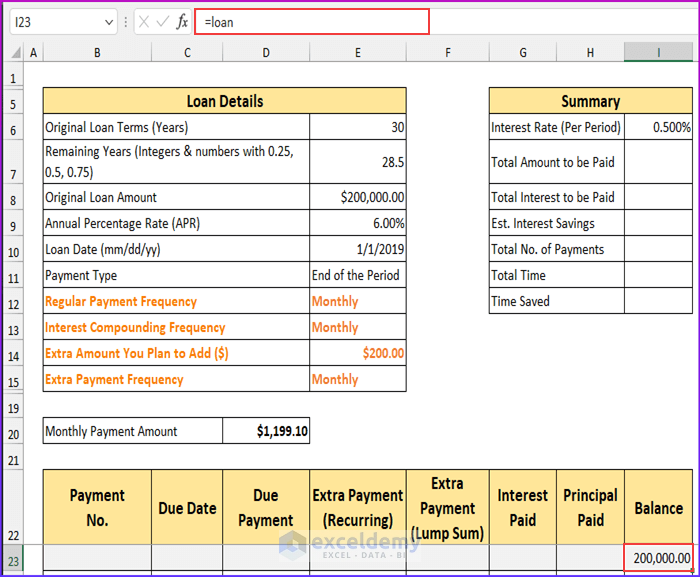

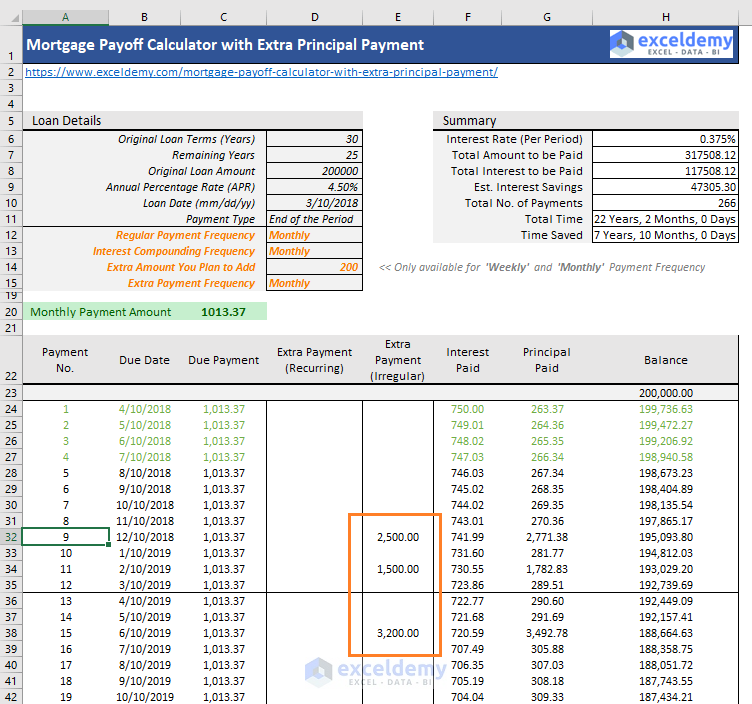

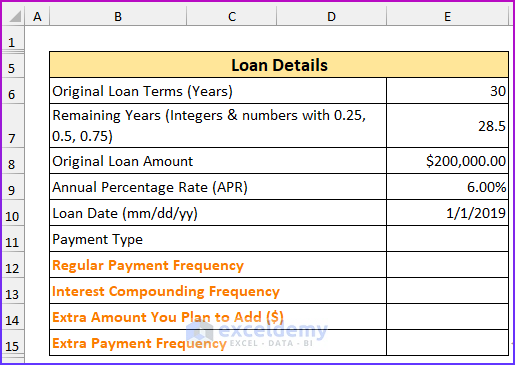

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

If youre able to make 200 in extra.

. For the same 200000 30-year 5 interest loan extra monthly payments of 6 will pay off the loan four payments earlier saving 2796 in interest. If youre able to. Since extra principal payments reduce your principal balance little-by-little you end up owing less interest.

What happens if I pay an extra 200 a month on my mortgage. In this scenario an extra principal payment of 100 per month can shorten your mortgage term by. Ad See Todays Rate Get The Best Rate In A 90 Day Period.

FHA VA Conventional HARP And Jumbo Mortgages Available. In this scenario an extra principal payment of 100 per month can shorten your mortgage term by nearly 5 years saving over 25000 in interest payments. Any extra repayments you make when you have a redraw facility can be accessed when you need them.

Paying Extra On Your Mortgage. So in the example that you. Throwing in an extra 500 or 1000 every month wont necessarily help you pay off your mortgage more quickly.

Paying extra is the cheap easy way to pay off your mortgage early If you have a mortgage chances are its a 30-year loan. Paying off the mortgage is a great goal to have especially if you have a 30 year mortgage. Greetings Friend Thanks for A2A and Appreciate your efforts to improve awareness in Financial literacy Congratulations it is a wonderful idea the extra amounts paid.

In this scenario an extra principal payment of 100 per month can shorten your mortgage term by nearly 5 years saving over 25000 in interest payments. And thats a long time to pay interest. Paying extra on your mortgage means that you make additional payments to your principal loan balance beyond your regular payments.

What happens if I pay an extra 500 a month on my mortgage. What happens if I pay an extra 200 a month on my mortgage. What happens if I pay an extra 200 a month on my mortgage.

For example if you pay 1300 per. On my 116000 mortgage paying an extra 200 per month put me on track to. If youre able to.

An offset account can help reduce the amount you owe on your. Paying extra on your mortgage means that you make additional payments to your principal loan balance beyond your regular payments. Since extra principal payments reduce your principal balance little-by-little you end up owing less interest on the loan.

In this scenario an extra principal payment of 100 per month can shorten your mortgage term by nearly 5 years saving over 25000 in interest payments. 455 36 votes If you pay 200 extra a month towards principal you can cut your loan term by more than 8 years and reduce the interest paid by more than 44000. Pay off your 400000 30-year mortgage in a little over 25 years and save over 36000 in mortgage interest by making 200 additional payments.

Fjyjpmyky7jrcm

/dotdash-INV-final-Ways-to-Be-Mortgage-Free-Faster-Apr-2021-01-43a0ae096f8542a081344ba976221702.jpg)

Ways To Be Mortgage Free Faster

Do You Know Just By Paying Your Monthly Mortgage Bi Weekly You Can Save A Lot Of Time And Money When We Take And Mortgage Calculator Excel Templates Mortgage

Should You Make Extra Mortgage Payments Compare Pros Cons

Extra Payment Calculator Is It The Right Thing To Do

Biweekly Mortgage Calculator With Extra Payments Free Excel Template Excel Templates Mortgage Payment Calculator Mortgage

Extra Payment Calculator Is It The Right Thing To Do

Mortgage With Extra Payments Calculator

/dotdash-INV-final-Ways-to-Be-Mortgage-Free-Faster-Apr-2021-01-43a0ae096f8542a081344ba976221702.jpg)

Ways To Be Mortgage Free Faster

Mortgage Calculator With Taxes Insurance Pmi Hoa Extra Payments

How To Budget When You Get Paid Weekly Budgeting Term Life Visual Learners

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Fjyjpmyky7jrcm

Saving 101 Archives Mintlife Blog Financial Freedom Budgeting Money Smart Money

Mortgage Calculator Calculate Mortgage Payment Tables And Total Costs Mortgage Amortization Calculator Mortgage Loan Calculator Mortgage Payment Calculator

Loan Amortization With Microsoft Excel Tvmcalcs Com Amortization Schedule Schedule Templates Schedule Template

Should You Make Extra Mortgage Payments Compare Pros Cons